How Florida Employers Can Read the Early Signs of Workforce Change

If you’ve been wondering what’s really happening behind the latest labor market headlines, you’re not alone. I wanted to dig deeper so I will be interviewing workforce economist Stephen Mallory, who breaks down the forces quietly transforming how we hire, retain, and restructure.

Lately, we’ve seen major employers like Amazon, UPS, and Target announce layoffs in the thousands. The reasons are familiar: the growing influence of artificial intelligence (AI), the reversal of pandemic-era hiring sprees, slowing consumer demand, and pressure from investors to cut costs. Yet, while these headlines make national news, their impact often mirrors what’s happening right here in our own backyard of South Florida.

Florida’s economy stands apart from much of the nation. The state’s top industries: real estate, professional and business services, leisure and hospitality, healthcare and education, and trade, transportation, and utilities are the very sectors that shape its economic heartbeat. Looking at 2025’s published Florida’s Worker Adjustment and Retraining Notifications (WARN) report, which require employers with 100 or more employees to provide 60 days’ notice before mass layoffs or closures, it’s clear that nearly all affected employers belong to these core industries.

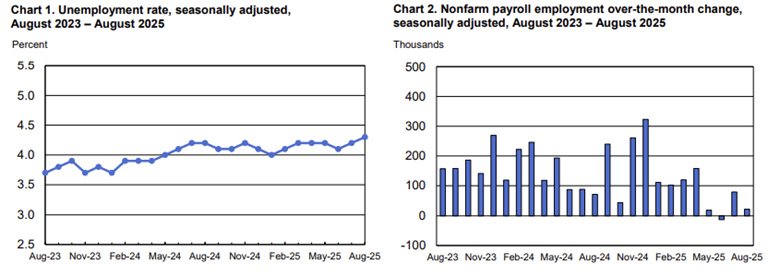

Chart 1 – Unemployment Rate and Payroll Employment Change (Bureau of Labor and Statistics)

Chart 1 shows the national unemployment rate rising from 3.7% in late 2023 to around 4.1% by mid-2025, while Chart 2 highlights monthly fluctuations in payroll growth. These patterns indicate a cooling labor market with inconsistent job gains, aligning with economist Stephen Mallory’s observation of a “post-pandemic correction.” Source: U.S. Bureau of Labor Statistics. Employment Projections: August 2025.

So, what’s driving these layoffs? And more importantly, how much of it can be linked to the ongoing government shutdown?

Economic slowdowns have always sent ripples through the labor market. When the housing market collapsed in 2008, job losses spread across nearly every industry. In 2020, the pandemic reshaped the workforce almost overnight. Now, in 2025, many economists describe the current phase as a post-pandemic correction, where both private companies and public agencies are recalibrating after years of rapid change.

The ongoing government shutdown adds another layer of uncertainty. Beyond the federal workforce, the effects are spilling into the private sector. According to reports, government shutdowns often trigger economic hesitation, companies cut back on hiring or reduce staff in anticipation of slower consumer spending and decreased demand from the government sector. Private contractors that depend on federal projects are especially vulnerable; when contracts are delayed or suspended, layoffs can quickly follow.

For Florida employers, particularly in industries like logistics, hospitality, and healthcare that rely on both consumer confidence and government funding, understanding how this ripple effects unfold helps HR leaders anticipate workforce challenges critical to workforce planning and stability.

To help decode what all of this means for Florida employers and HR leaders, I reached out to someone whose work sits at the very center of the data that drives these national decisions.

Expert Economist

Stephen Mallory is a Senior Economist with the federal government who’s analyses help shape the numbers that inform the President, federal agencies, and private sector leaders about the true state of employment, goods, and services across America.

With more than a decade of experience in economic policy and data modernization, Mallory has helped modernize labor reporting systems that save taxpayers millions annually while improving the accuracy and timeliness of the nation’s employment insights. His expertise has become a bridge between policy and practice, translating complex labor data into actionable intelligence that helps leaders understand the real story behind hiring, retention, and workforce participation.

In the candid interview with Stephen, we discuss how a government shutdown ripples into the private labor market especially in sectors that directly impact Florida’s economy. We explore which early economic indicators HR leaders should monitor before layoffs become necessary, what local labor data can reveal about future workforce stability, and how long workers typically remain unemployed after displacement.

Stephen also shares his personal experience navigating the current shutdown as a federal worker and what lessons private sector HR executives can draw from how the government manages workforce interruptions.

Interview

Since the focus is on the government shutdown, let’s start with how it impacts the private sector labor market in Florida. Especially in real estate, healthcare, food transportation distribution, and hospitality.

Stephen: Generally, retail and hospitality feel the shocks quickly because demand relies on the paychecks people aren’t getting during the shutdown. Tourism is also tied to areas where federal jobs are concentrated, so those regions tend to see the first declines.

Short shutdowns usually just mean fewer weekend dinners or lower hotel occupancy. But longer shutdowns create more significant effects, and businesses often start leaning toward layoffs.

Healthcare tends to be more resilient, but federal funds do play a role. Delays in reimbursements can disrupt cash flow for hospitals and clinics, especially those that rely heavily on federal billing or elective procedures. Contractors and research grants are also affected when funding lapses.

In logistics and food distribution, contract pauses and reduced consumer spending create demand shifts. Perishable goods are vulnerable to timing shocks, and logistics firms that handle federal shipments often postpone hiring or cut overtime.

Longer shutdowns typically result in layoffs, reduced hours, and hiring freezes.

What’s the impact of a shutdown on employment stability in Florida?

Stephen: The short answer is uncertainty. A shutdown reduces disposable income for furloughed workers, laid-off employees, and contractors. It delays permits and disrupts business services that private companies rely on. Those disruptions create demand and cash flow shocks that eventually spill into the private labor market.

What signs should HR leaders look for that indicate their company might be next to feel the effects?

Stephen: There’s a lot of good data out there from the Bureau of Labor Statistics (BLS) and major outlets like the Washington Post.

If your company depends on federal funding, look at how much of your revenue comes from federal contracts or grants. If those revenues start to decline, that’s an early sign your company may soon be affected.

When the housing market collapsed in 2008 and in 2020, the pandemic all resulted in mass layoffs. In 2025 we are starting to witness the same occurrence. What early economic indicators should companies watch that suggest workforce reductions might be ahead?

Stephen: Rising unpaid invoices from government clients or delayed approvals for bids and permits are red flags. Also, pay attention to early unemployment claims. The BLS publishes this data monthly, it’s a great way to track labor market conditions.

Are there specific data points (like consumer spending, unemployment claims, or job openings) that correlate with upcoming layoffs?

Stephen: Yes. Initial unemployment claims are one of the most reliable, near real-time indicators of layoffs. When those spike, unemployment is likely to rise.

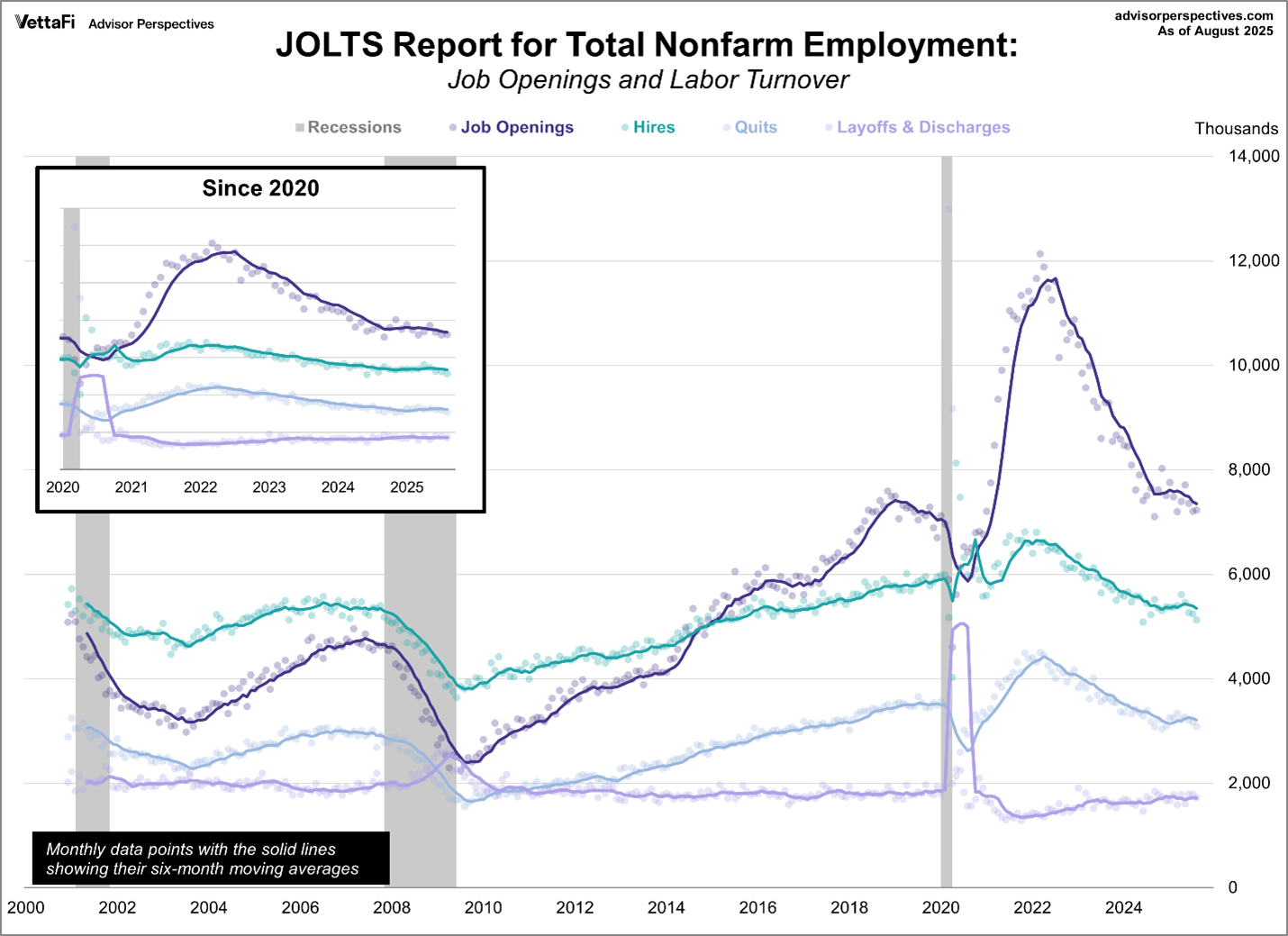

The JOLTS report (Job Openings and Labor Turnover Survey) is another. Falling job openings and rising layoffs indicate a contracting labor market.

Consumer spending data, like credit card trends, can also reveal weakness. Sharp drops in retail spending signal lower demand, and firms respond quickly to that.

Finally, ADP payroll data can help detect slowing hiring before the official reports come out. Combining these data sources gives companies a clearer picture than relying on one alone.

Chart 2 – JOLTS Report: Job Openings and Labor Turnover (Advisor Perspectives)

The JOLTS report visualizes a decline in job openings and steady levels of layoffs since 2022, signaling that labor demand is moderating even as hiring stabilizes. This pattern supports Mallory’s insight that employers are becoming more cautious with staffing amid uncertainty. Advisor Perspectives. JOLTS Report for Total Nonfarm Employment: Job Openings and Labor Turnover (August 2025).

I would love to understand the “Human Cost” through your data. When economists look at layoffs, what trends do you see in how long people stay unemployed?

Stephen: It varies by business cycle and industry. Recent BLS data shows that when labor demand softens, the median and average duration of unemployment rises, meaning people stay jobless longer.

Are there differences in recovery rates between industries, or between frontline and executive-level employees?

Stephen: Yes. Older workers and those in higher-level roles often experience longer unemployment periods. Frontline or lower-skilled workers tend to find new jobs faster, though often lower-paying or part-time ones, which saves employers on benefits.

Executive and specialized roles take longer to fill because of search and negotiation complexity. Research consistently shows that displaced mid-career workers, especially men, experience lasting earnings losses.

Industries like tech and consumer discretionary rebound faster but are more volatile, while healthcare and education recover more steadily because demand remains strong.

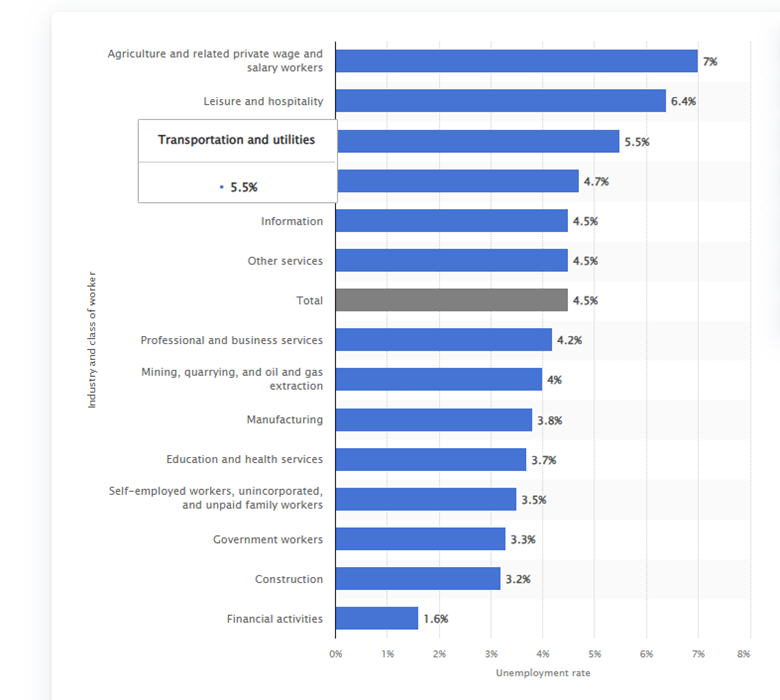

Chart 3 – Unemployment Rate by Industry (Statista)

This chart illustrates unemployment rates across U.S. industries as of August 2025. Agriculture, leisure, and transportation report the highest rates, while finance and construction remain more stable. These differences mirror Mallory’s comments about the uneven pace of recovery across sectors. Statista. U.S. Unemployment Rate in 2025 by Industry and Class of Worker.

What does the data tell us about the effectiveness of outplacement or retraining programs?

Stephen: The evidence is very positive. High-quality outplacement and retraining programs improve job matching and long-term employment stability.

Studies show that these programs also reduce the psychological strain on displaced workers. Employers who invest in them see returns through lower litigation risk, stronger branding, and higher rehire potential.

Let’s shift gears and talk about the future of work & post-layoff recovery. Where do you see the job market heading in 2025–2026 for displaced workers?

Stephen: Workers will increasingly move into sectors less affected by economic shocks like education, healthcare, and clean energy. Education, for example, always needs people. The downside is that educators remain overworked and underpaid, but the field is stable.

Which industries are rebounding or emerging as new hiring centers after a downturn?

Stephen: Healthcare and education remain steady. Clean energy and certain construction sectors are also growing. We’re seeing some weakening in tech and corporate services where AI-driven automation boosts productivity but reduces headcount.

What skills should laid-off employees focus on developing now to stay employable in a changing economy?

Stephen: Build adjacent skills—ones close to what you already do. That way, you expand your opportunities without starting from scratch.

Stephen, you are a economist for the federal government so that makes you a federal worker, I wanted to ask you if the government shutdown impacted you personally. How has the shutdown affected your own work as an economist?

Stephen: There’s a lot of uncertainty—furloughs, pay delays, and financial stress. During my furlough, I asked myself what I could do to protect against this in the future. I’m currently in school getting my master’s in education so I have a fall back.

Helping others has been one of the best ways to cope. When I focus on helping others, it takes my attention away from my own challenges and creates a sense of purpose.

What lessons do you think private sector HR leaders can learn from how the government handles workforce interruptions?

Stephen: HR should have a clear plan for workforce interruptions that includes identifying essential roles, transparent communication, and processes for furloughs versus permanent layoffs.

Compassionate, predictable communication helps reduce anxiety and preserve trust. That keeps morale high among remaining employees and maintains goodwill with those who are leaving.

I would like to thank Stephen Mallory for providing his professional perspective. His insights remind us that behind every economic headline are real people navigating uncertainty. For Florida’s employers and HR leaders, the key is preparation and understanding how government policy, consumer behavior, and early data indicators converge to shape workforce decisions. Whether through proactive communication, outplacement support, or skill development, organizations that anticipate change will be best positioned to weather whatever comes next.